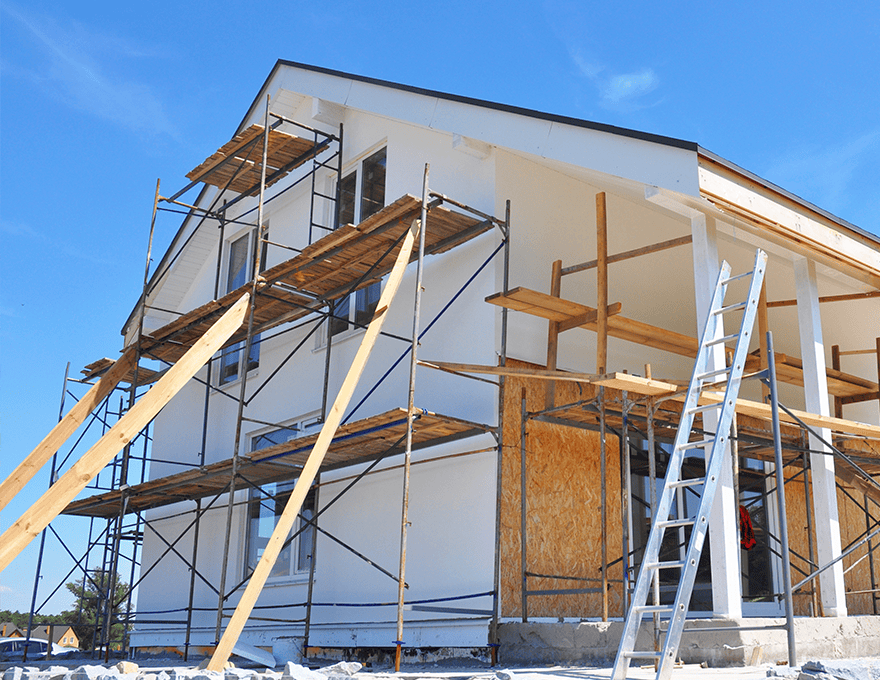

Financing for Commercial

Creative loan structures for apartments, office, retail, and more

More Than a Lender

We are California's premier commercial hard money lenders. We specialize in providing loans up to $20 million to meet a wide range of needs. Whether you want to purchase a commercial property, secure a second loan, or fund tenant improvements for a construction project, we’ve got you covered.

Real People, Real Funds

We're a proven partner for business owners, developers, and investors.

No Prepayment Penalty

Competitive Interest Rates

Fast Funding

How Our Loans Help You

Learn about our variety of commercial financing options.

Owner-User Property Loans: These loans are tailored for business owners who plan to occupy the purchased commercial property. They offer advantageous terms, including lower interest rates, due to the borrower's intended use for their business operations.

Complex Mixed-Use Property Loans: These loans cater to properties that combine various functions, such as retail, residential, and office spaces. Available loan options consider the diverse revenue streams and usage of these properties, offering flexibility for investors and developers.

Multi-Property Loans: These loans provide financing for multiple commercial properties, enabling efficient management and expansion of real estate portfolios with favorable terms compared to individual property loans.

Additional Creative Loan Structures: Creative loan structures provide innovative financing for diverse commercial property needs—including bridge, mezzanine, and construction loans—empowering borrowers to execute complex projects and investment strategies.

What Our Customers Say

Fund Your Next Project

Discover the step-by-step guide to our commercial property loan process.

Application and Prequalification

Our loan officer will schedule an initial consultation to discuss your financial goals. We utilize documents such as income statements and credit reports to assess your eligibility and loan amount. From there, we work together to determine your loan options and potential interest rates.

Processing and Underwriting

Our in-house processing guarantees efficiency. We verify documentation—including credit reports, income, and property appraisal—to assess your credit standing and property value. After approval, we finalize your loan terms and, upon closing, disburse your funds for your commercial property transaction.

Closing and Disbursement

We schedule a closing appointment to sign your loan documents. For purchase loans, funds are transferred to the seller, transferring property ownership. For refinance loans, the existing mortgage is paid off, and cash-out funds are disbursed to the borrower. We provide post-closing support to address any queries or concerns you may have.

Lending Insights

Learn more about private real estate lending and how it can help you.

Ready to Get Funded?