A History of Excellence

Herzer Financial has been a premier California lending partner since its founding in 1950 by Fred Herzer, Jr. We uphold this legacy with innovative loan programs and active participation in the California Mortgage Association, fostering education and excellence in private lending.

Investing in You

We specialize in tailored private real estate loans, offering a wide range of options for consumers and investors. Our loans include ground-up construction, fix-and-flips, bridge loans, consumer loans, and more.

We understand that certain real estate ventures can be deemed too risky by traditional banks. Our expertise in private lending bridges the gap, ensuring borrowers have the necessary financial support for their real estate goals.

The Herzer Advantage

Learn why we're California's premier private real estate lender.

Relationship-Focused

Flexible Programs

Build IQ

Meet Our People

Success starts at the top.

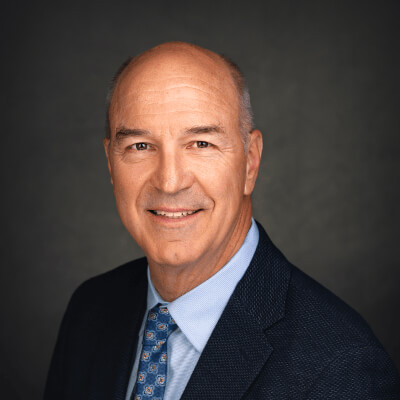

Roy Malone

President

Roy Malone is the President of Herzer Financial. Prior to Herzer, Roy was one of the founding executives and President of Golden Pacific Bank. Over the past 30+ years, he has filled many executive and operational roles, primarily in the community banking space. Roy maintains a real estate brokers license as well as a general contractors license.

Roy grew up in the Sacramento area. He attended UC Davis and graduated from California State University of Sacramento with a BS in Business Administration concentrating in Real Estate and Land Use. He has served on several boards, is a member of the FBI Citizens Academy, and manages a private venture capital fund.

Roy and his wife Trisha raised their four kids (now adults) in El Dorado County. When he’s not at work or with family, he is often competing in multi-day endurance events in wild parts of the world.

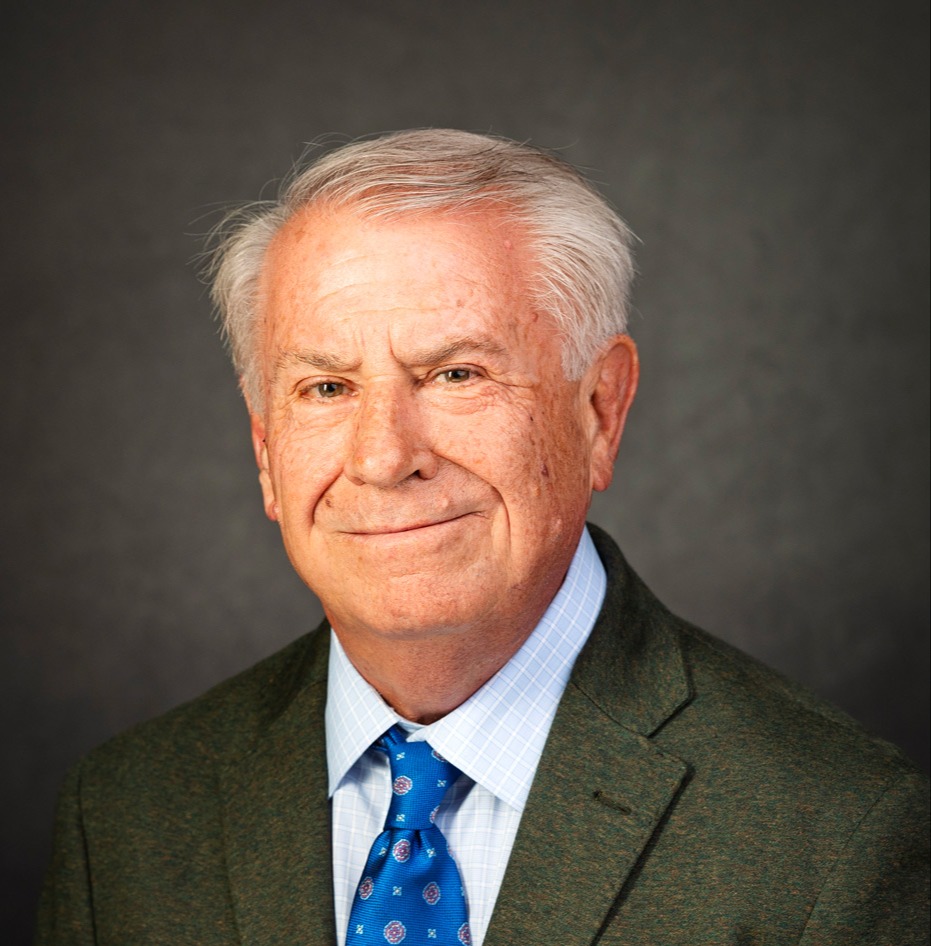

David K. Herzer

Vice President & Co-Founder

David is Vice President and co-founder of Herzer Financial. He has been a licensed real estate broker since 1985 and holds a Mortgage Loan Originator consumer lending license. He graduated with a Bachelor of Arts degree from the University of California at Berkeley and graduated with honors from Bellarmine College Preparatory in San Jose.

Mr. Herzer is actively involved with California Mortgage Association (CMA), the trade association for private real estate lenders. He has served on the Board of Directors since 2010 and is past President. He has also presented on educational panels for CMA and the California Association of Mortgage Professionals (CAMP).

Mr. Herzer is a former Director of the Menlo Park Rotary Club and contributes to the Berkeley Food Project, Rebuilding Together, the UC Berkeley Disabled Students Program, and several other charities.

David lives in Marin with his wife and two children and enjoys drumming, mountain biking, skiing, and water skiing, when he is not injured.

Nancy Gann

Operations Manager

Nancy Gann has been with Herzer Financial since 1999. She has held a Real Estate Salesperson license since 2005 and has over 35 years of experience in the lending and mortgage industry. Nancy has taken classes at Canada College in Redwood City, California, and the University of Maryland in College Park, Maryland. She holds a current Notary Public Commission with the State of California. Along with her continuing education courses, she has also attended numerous classes for loan servicing and originating and numerous seminars held for the mortgage industry.

Nancy currently lives in Tracy, California, with her family. In her free time, she enjoys traveling, quilting, and wood decoy carving.

Joe McNulty, MBA

Senior Construction Lender

Joe has been a Senior Loan Officer at Herzer since 2019. In addition to being a licensed Real Estate Broker, he has over 20 years of experience in the lending and mortgage industry. Joe has an undergraduate degree in finance from the University of Rhode Island and an M.B.A. from INSEAD in Fontainebleau, France. He has personally been invested in ground-up construction and rehab projects over the years. He enjoys all of the intricacies involved in private lending.

Joe speaks French and Spanish, enjoys traveling, running, and rooting for his beloved Chelsea Football Club and, of course, the Golden State Warriors. He has coached youth soccer teams in the Bay Area for over 10 years.

Bill Lercari

Senior Construction Lender

Bill is a seasoned lender with many years experience in structuring finance, real estate appraisals, and construction management. He has a BA degree from the University of California, Berkley and hold both a California Real Estate Broker license and a Mortgage Loan Originator license.

He lives in Truckee, California and enjoys hiking, biking, and winter sports.

Terry Conner

Construction Administration

Terry's experience includes 23 years as general contractor and the last 22 years as a construction lender. He has held senior lending titles at multiple institutions and has vast knowledge of the construction process. His performance and attention to detail has resulted in numerous awards over the years including joining the Circle of Excellence and President’s club.

Outside of the office, he can be found exploring small towns and learning about the area from the locals. And if there happens to have a golf course somewhere nearby, you'd probably find him there too.

Ready to Get Funded?